GOLF TECH BOOM OR GOLF TECH BOOMERS?: GATHER WHITE PAPER #7

The marketing of golf technology tends to reflect a younger generation of elite players.

Do these campaigns represent who uses golf technology?

Golf’s Technology Boom

Golfers may like honoring the game’s traditions, but not when it comes to game-enhancing technology.

Players are embracing gadgets that make the game more fun, trackable, and transparent. And although the game’s traditions may still loom, technology means golf now looks very different to the game our grandparents played.

At the range, golfers track their swings and shot patterns. On the course, wearable technology provides data analysis of past shots and uses historical data to recommend club selection for the next ones. Club fitters use artificial intelligence to enhance equipment recommendations, and players employ phone apps to track scores and establish handicaps.

These technologies are big business. According to research by the National Golf Foundation, approximately 40% of regular golfers use a golf app. And that percentage is likely to grow along with the market value of global sport technology - expected to reach $41 billion by 2027.

Advertising Golf Technology

Golf technology is marketed as a tool to improve players’ games. It can, and it does.

But is game improvement really the hook that engages golfers and drives future technology use?

No doubt, golfers are motivated by game improvement. But in addition, golf technology engages its users by providing knowledge - about the course, their swing, and their performance. Technology also gamifies golf by offering a game within a game.

So is game improvement behind the proliferation of golf technology, or is it the added layer of entertainment it provides?

Knowing the answer to this question can help us understand who is likely to use golf technology and how to advertise it.

The Value of Golf Technology

Some academic researchers have shown that golf technology engages athletes seeking information. It also drives their engagement and commitment. A golf example of this may be an app that includes data about specific shots and course characteristics. Relevantly for golf, sports apps engage both younger and older users, and especially less-skilled and less-committed players.

As golf strives to increase its market share (see Gather White Paper #1), these findings are important to understand.

While it may be sexy to market golf technology as a tool that promotes high-performance play to a younger market of golfers, who really uses it?

We went looking for answers with the help of Hole19.

Case study: The Hole19 App

The Hole19 app provides GPS yardages, distance tracking, performance analysis, scoring functions, and live leaderboards. For the purposes of this paper, Hole19 can also tell us who uses its golf technology.

To assist Gather’s analysis, the Hole19 team provided Gather with one day of data (for play in February 2022) so we could probe for trends in player behavior and explore demographics of their users. We narrowed the data to three golf markets.

1. The United States (3,929 users)

2. Europe (4,956 users)

3. Great Britain & Ireland (7,502 users)

We found significant regional differences in technology use. So, in addition to describing who uses on-course technology, we also compared users by region.

Age and Hole19 App Users

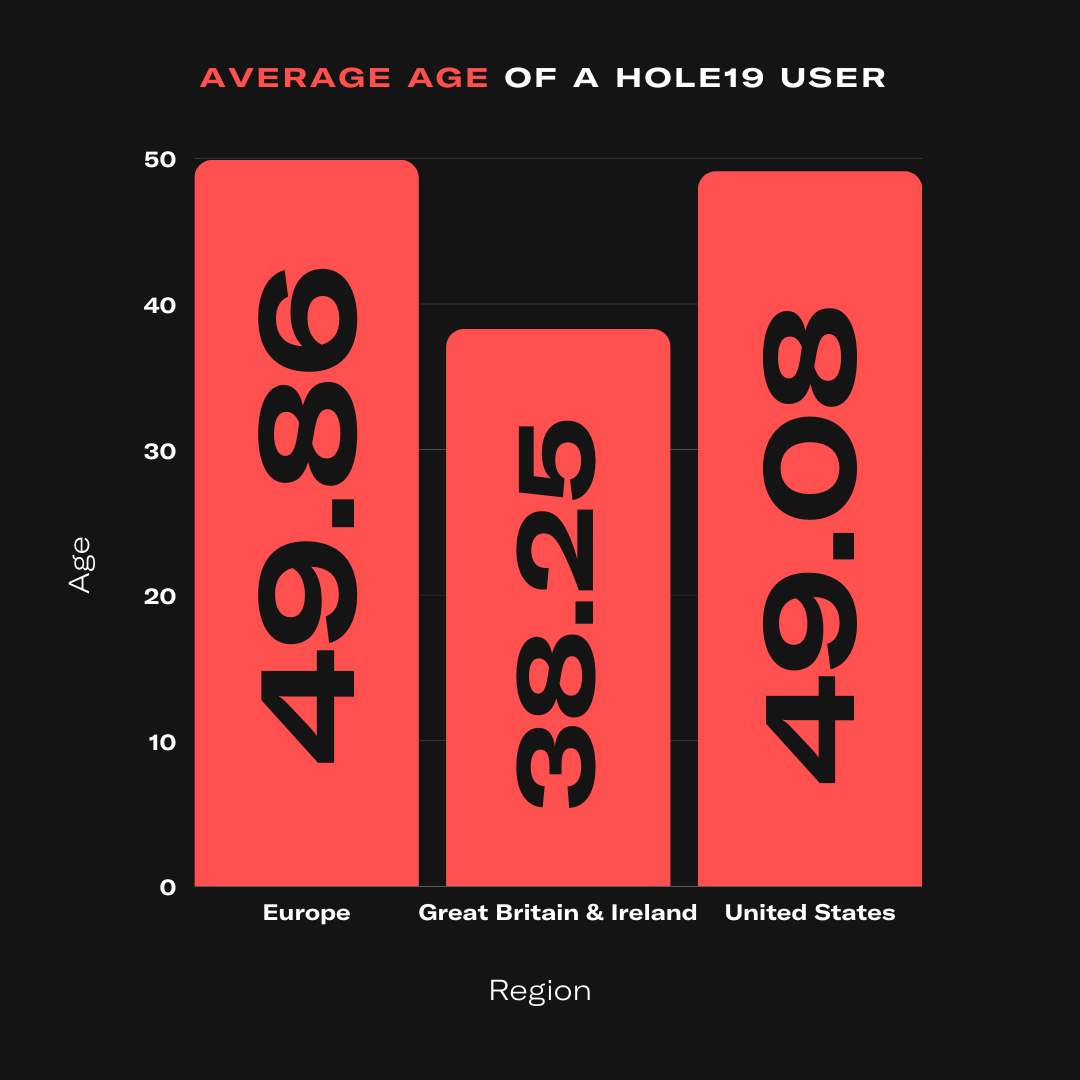

Hole19 app users differed in age across the three geographical regions.

Although the age range of users was similar (between 16 years and 80 years), the average user age varied widely. In Europe, it was 49.85 years. This was the oldest age of app users across the three regions, followed by the United States (49.08 years). Users in GB&I (38.25 years) were the youngest.

These data show what should be intuitive, that the average age of the Hole19 app user coincides with the average age of golfers in each region. For example, the average age of GB&I golfers in 2021 was 41 years old. The high correlation between Hole19 app users and average-aged players tracked similarly across all three regions we explored.

So what?

When marketing conveys an implicit assumption that golf technology is for younger players, it fails to connect with the golfers most likely to use it.

The Hole19 data demonstrates that the market is much bigger than GenZ and Millennial golfers.

By focusing marketing campaigns too narrowly on younger players, golf technology companies may be missing out on a much larger piece of the pie.

Handicaps and Hole19 users

The assumption that golf technology is favored by elite players was debunked by Hole19’s data. Men using the Hole19 app had handicaps significantly higher than the regional national averages. Women golfers represented in the data had handicaps that matched the respective national averages – but these were significantly higher than men’s handicaps. Great Britain and Ireland national averages. United States national averages.

So what?

The cohesive narrative emerging about golfers that use on-course technology contradicts conventional wisdom, but not social science. The persona of Hole19 users is not younger or ‘better’ than the average golfer.

Instead, data suggests that golf technology users reflect the typically-aged golfer – but one who is less skilled, or who plays more infrequently and casually.

Gender and Golf Technology

Women golfers do not yet embrace golf technology.

In the Hole19 sample, women make up 11% of European users, 1.61% of GB&I users, and 5.58% of users in the United States. Collectively, women golfers make up only 6.75% of Hole19 users. Although women in these three markets tend to be later adopters of technology than men, this alone does not account for the gender discrepancy between golf technology use of men and women.

So what?

Once again, women golfers provide an opportunity for growth. In terms of reaching women golfers, marketers may reconsider their messaging and advertising imagery.

When marketing golf technology to users, those who see the product as useful for their own improvement or enjoyment will be more likely to try it.

Hole19 and Playing Habits

Considering the characteristics of Hole19 app users so far, it should be no surprise that golfers using the app trend towards being casual players. This is especially true in the European market.

Players in Europe opted for 9 holes of golf almost 50% of the time. By comparison, American and GB&I golfers played 9 holes for 27% and 20% of their rounds respectively.

Golf industry experts suggest more players prefer the time efficiency of 9 holes. These data demonstrate that the shift to shorter games is already happening in Europe. More so than in the USA or GB&I. The difference could be cultural, or partly explained by the planned development of 6- and 9-hole courses across Europe that are less evident in GB&I and the USA.

So what?

Does golf technology market to casual players? It should.

Knowing who uses golf technology can inform the development, marketing, and advertising strategies of products. Apps must be able to accommodate and easily switch between 9- and 18-hole playing options. And that flexibility should be communicated.

Conclusion…

We took a snapshot of the Hole19 on-course app data to better understand who uses golf technology. Based on our findings, these are our conclusions.

Emerging golf technology is exciting, and it is changing how golf is played. However, its users are not as young and advanced as one may expect. In the regions we examined, users are grass roots players of average age, and if anything, slightly worse-than-average skill level.

There is a disconnect between who we think uses golf technology, and who does not. This may be partly explained by how apps gamify golf. For less skilled golfers (those we found to be the typical users), gamification is a key element for engagement.

These data point towards an untapped women’s market. Golf technology has an opportunity to increase its market share of women users with different marketing and communication strategies.

QUESTIONS?

ASK US ANYTHING!

VALUABLE?

We would love to know what you think about your Gather White Paper #7!

Tell us in just 1 minute: Did Gather White Paper #7 offer any value to you and your own business practice?