THIS PAPER DOES NOT TELL YOU THAT MORE WOMEN SHOULD PLAY GOLF: GATHER WHITE PAPER #3

This White Paper will not do these things…

It will not tell you that more women should play golf. It will not even refer to the disparity in participation between men and women golfers.

Instead, this White Paper will give you data driven insights about women as consumers. And it will tell you why the magic number is five.

WHY FIVE?

When do women with an interest in golf make a financial commitment to it?

Yes, after five years.

If we keep women engaged in golf for five years, chances are they stay. Unfortunately, half of new women players drop out before reaching that milestone. (Only a quarter of male golfers quit in the same time frame.)

Five years is when, as consumers, women golfers act on their brand awareness. Their preference shifts from generically named, priced-right equipment, to brand champions. And five years is when more women play on the course more often. In the world of women golfers, the number five provides challenges, but also many opportunities.

FIVE AND GOLF EQUIPMENT

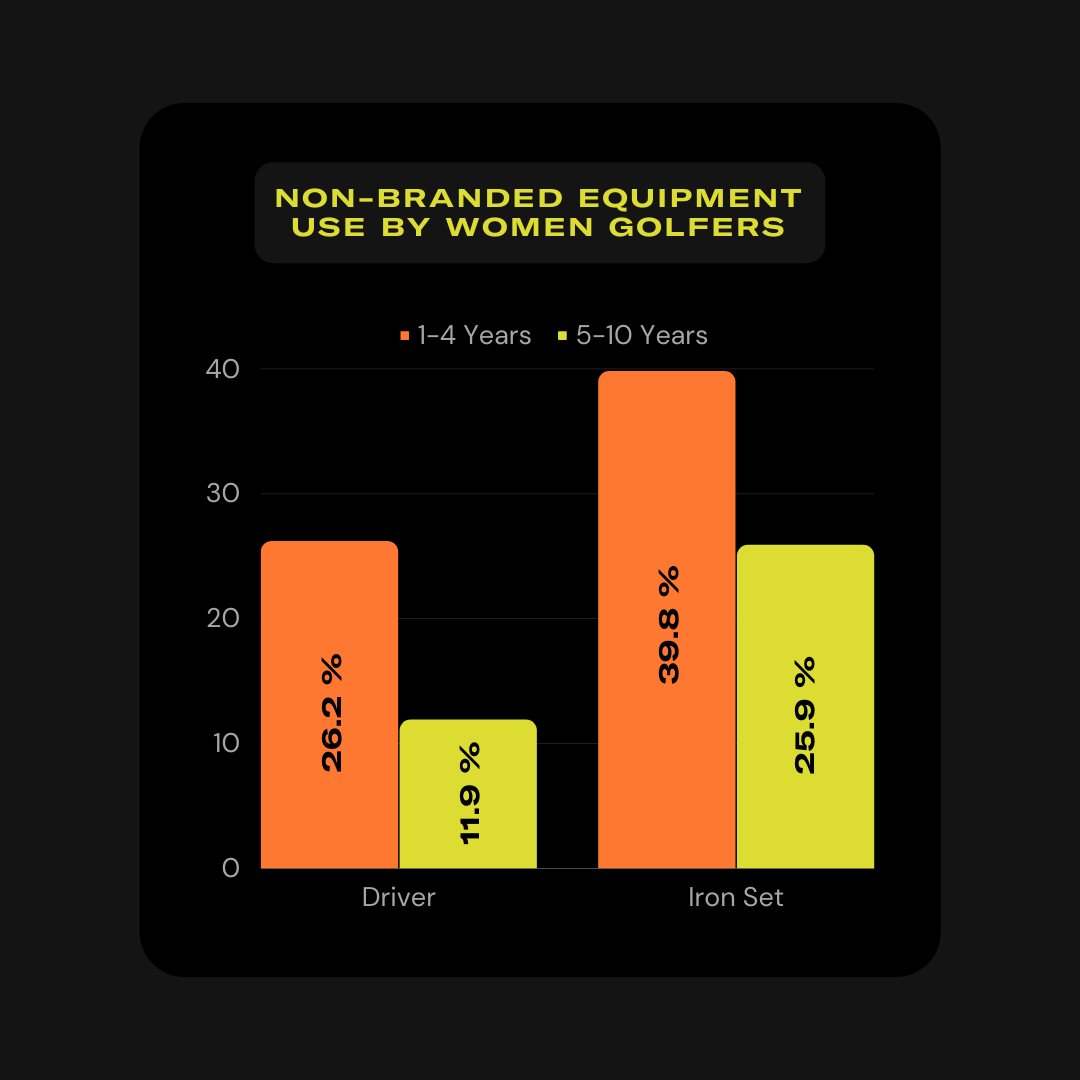

Over 700 UK-based women golfers were asked to identify what equipment they currently use. The answers were coded to represent branded, or non-branded clubs. Over 26% of women golfers who had played for less than five years used a non-branded driver. Move on five years, and only 12% of players used a non-branded driver. Not only is that difference huge, but it is statistically significant. As women golfers used less non-branded drivers, they used more branded technology.

The same trend emerged when we looked at iron sets. Almost 40% of women golfers in the one-to-four-year playing category used non-branded irons. That number shrinks down to just 26% for golfers who played for five years or more.

THE FIVE YEAR SHIFT MAKES SENSE

This shift in brand commitment makes sense. With few exceptions, non-branded clubs cost less than top-branded equipment. If you are new to golf -- and are not yet committed – it’s pragmatic to hold off on investing in top-notch equipment. Women golfers probably become aware of branded equipment as they play more. Then start pulling the trigger on purchases around year five.

GOLF MANUFACTURERS: NOTE TO SELF

If you’re a golf equipment manufacturer, we hope we have your attention. Based on these data alone, you have an incentive to keep women golfers playing past the five-year threshold. After that, the likelihood of them buying your product grows significantly. So, what would that incentive look like? We’re spit-balling, but here are some suggestions.

Let’s start by pulling in data from other studies.

Women golfers who have played less than five years are more interested in, and take significantly more lessons, than players who have made it past the five-year mark. So, an obvious place to start is supporting golf instructors. But probably not just any golf instructors. (We have interesting data on how some instructors are more effective at motivating women golfers than others, which is why rolling out nation-wide initiatives rarely work. But we’ll leave that for another day).

Instead, identify golf instructors who have a successful track record of delivering programs at the grassroots level. This may, or may not, be women-only programs. But any grassroots golf program worth its salt will, by default, have a high percentage of women participants.

What would support of golf instruction programs look like? One example is supplying clubs for new golfers to use in classes. This simple marketing initiative would produce a compounding effect. You would be encouraging and supporting new women golfers to stay in the game while also developing brand loyalty with future golf-equipment consumers. To maximize the compounding effect, identify a good instructor and program, and provide the financial support that he or she needs to expand it.

HOW VALUABLE WOULD IT BE TO CLUB MANUFACTURERS IF GOLF RETAINED 10% MORE WOMEN PLAYERS?

Very.

The R&A and Sports Marketing Surveys reported that across all markets, 5.6 million players took up or returned to golf between 2016 and 2021. In the USA, 31% of newcomers were women (NGF) – and for this calculation we will apply this number globally. This equates to 1.7 million new women golfers around the world. If we retain 48% of this market, like normal, we will gain 833 thousand players. If we do 10% better and retain 58% of women golfers after five years, we gain about 1 million players. That is a difference of 173 thousand women golfers who could become consumers. If, as our data suggests, at about 75% of this cohort buy top-branded clubs, that means 130 thousand more golfers are ready to invest in equipment. We can expect players to spend £1,500 on clubs, which equates to an additional £195 million globally in additional club sales over a five-year period.

Wow.

And imagine if we could retain even more than 58% of players, just with golf industry collaboration.

FIVE AND PLAYING HABITS

What else is there about the number five and the journey of women golfers? It tells us how different players engage with golf facilities. In the same sample of 700 UK-based women players, over 12% just practice in their first four years of taking up the game. They don’t go onto the golf course. Not once.

Fast forward five years, and less than 1% of women golfers are exclusively range rats.

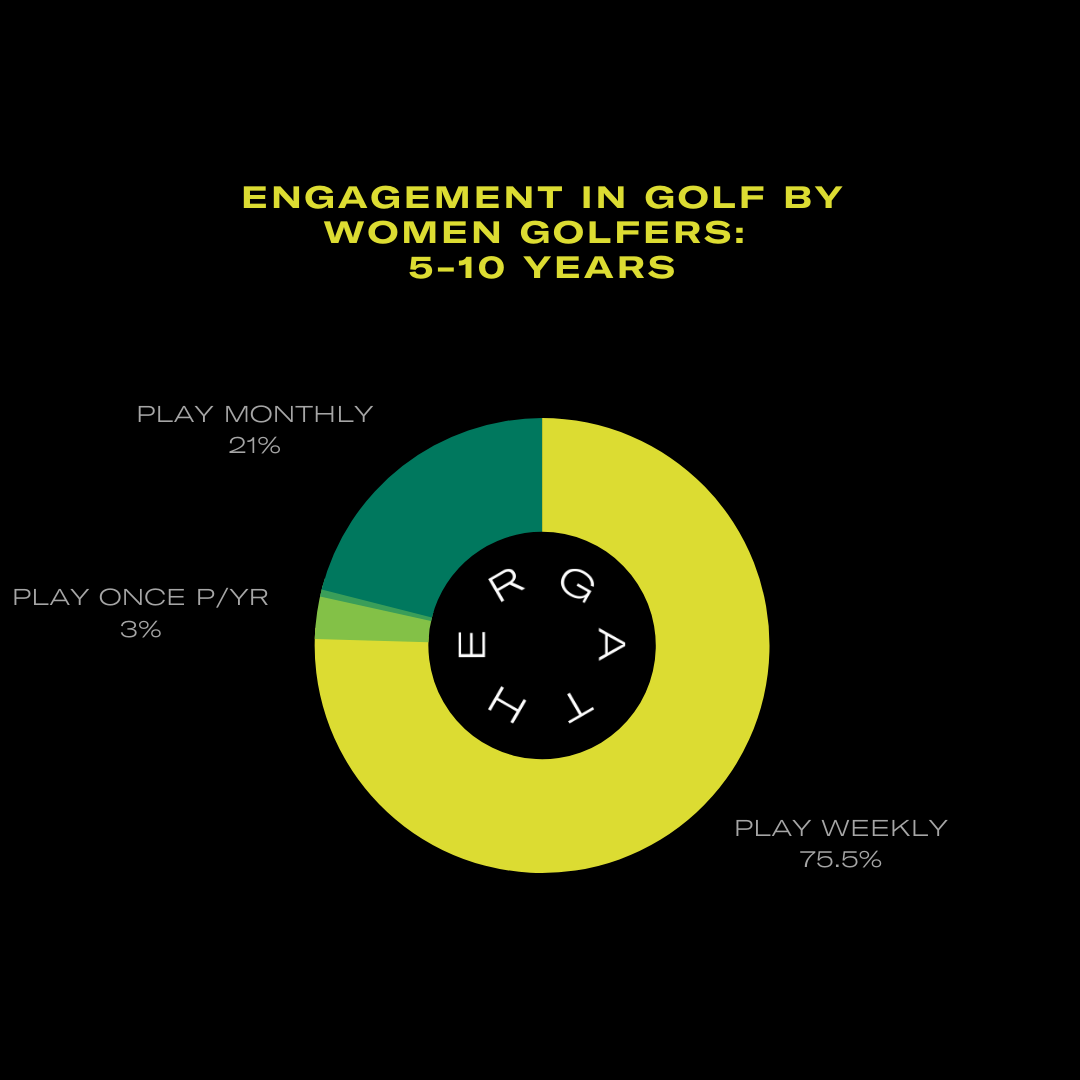

Of course, there is a practical consideration here. When learning to play, it’s important to spend time in an environment more conducive to experimenting – the range. But if over 12% of new golfers never get to the course in the first four years of playing, aren’t we missing the point about why they took up the game? You’ll also notice that the slice of pie grows significantly for the percentage of women who play at least once a week. Under five years and its 55%. Between five and ten years it jumps up to 75%.

golf COURSE OPERATORS: NOTE TO SELF

Golf facilities have a vested interest in transitioning new women golfers from the range to the course. More women who play weekly is good for business, right? The trick is getting new women players to take their game to the course without losing them along the way. Thankfully, achieving this doesn’t have to be a guessing game.

Social science can give us some clues here. When a leisure experience fulfils people’s psychological needs, they are more likely to stick with it.

What are the psychological needs that recreational players are looking to fulfil?

Researchers identified: Autonomy (choosing to play instead of feeling obligated to play); experiencing success or progress; and establishing friendships with other players. Another study of golfers quantified the importance of ensuring a good on-course experience. The better the experience golfers had, the more committed they were to the course, and the more they played it.

Applying these insights to women golfers on the precipice of continuing to play or quitting, practical solutions may look like this.

Make the golf course experience satisfying rather than demoralizing for women players. This may start with auditing your course’s tee options. USA-based club fitters Club Champion and golf course architect Kari Haug collected data on women golfers' ball flight characteristics.

"Based on these data, most golf courses aren't set up for new women players to succeed. If your course's most forward tees are longer than 5,000 yards, you have a problem...and that is just for starters. The design also needs adjusting if you want newcomers to have a fun and successful golf experience."

Kari Haug

If your facility doesn’t have programs that take new golfers from the range to the course, introduce some. You can do this in-house, or partner with one of the emerging community-based golf start-ups that target new players. Community-based programs tend to be stuffed with new players who are eager to become golfers (that is the autonomy box checked). And they fulfil the psychological need to develop friendships as part of the leisure experience. Whichever strategy is taken, it’s a win-win. The golf facility helps new players transition to the course – and in doing so, increases the chance of retaining them as consumers. And the community-based golf groups have a facility for their players to grow and stay engaged.

HOW MUCH WOULD GOLF COURSE REVENUE INCREASE IF 10% MORE WOMEN PLAYERS WERE RETAINED?

For potential golf course revenue, we’ll make the same assumptions used to estimate potential golf equipment sales. A 10% increase in retention of new players equates to 173 thousand more women golfers globally over a five-year period. We know that about 55% of this cohort – 95 thousand – will play on the course once a week.

Assuming a very reasonable price tag of £25 a round (£1,300 annually), an extra 10% retention of women players is worth an additional £617 million globally in golf course revenue over 5 years.

Worth re-evaluating your strategies to increase retention rates, don’t you think?

FIVE takeaways…

Attracting women to golf isn’t the problem. Getting them past the five-year mark is.

Forget conventional wisdom. Use data-driven insights to develop effective strategies that increase the odds of keeping women in golf.

By studying the consumer behaviour of women golfers, we can identify industry stakeholders with a vested interest in their retention.

Strategies should focus on retaining women golfers. Not just recruiting them.

Gestalt theory applies: The whole is greater than the sum of its parts. In the case of women golfers, collaboration between industry stakeholders will be more effective than them each operating individually.

QUESTIONS?

ASK US ANYTHING!

VALUABLE?

We would love to know what you think about your Gather White Paper #3 !

Tell us in just 1 minute: Did Gather White Paper #3 offer any value to you and your own business practice?